Content

- How can Online pay day loans Jobs?

- Try Loanpig Moderated?

- Cfpb Reveals Capturing Changes It is possible to Payday Lending

- Ftc, Arizona Attorney As a whole Cease Chicago Industries Usability Faced with Illegally Putting pressure on Individuals To pay for phantom Debts

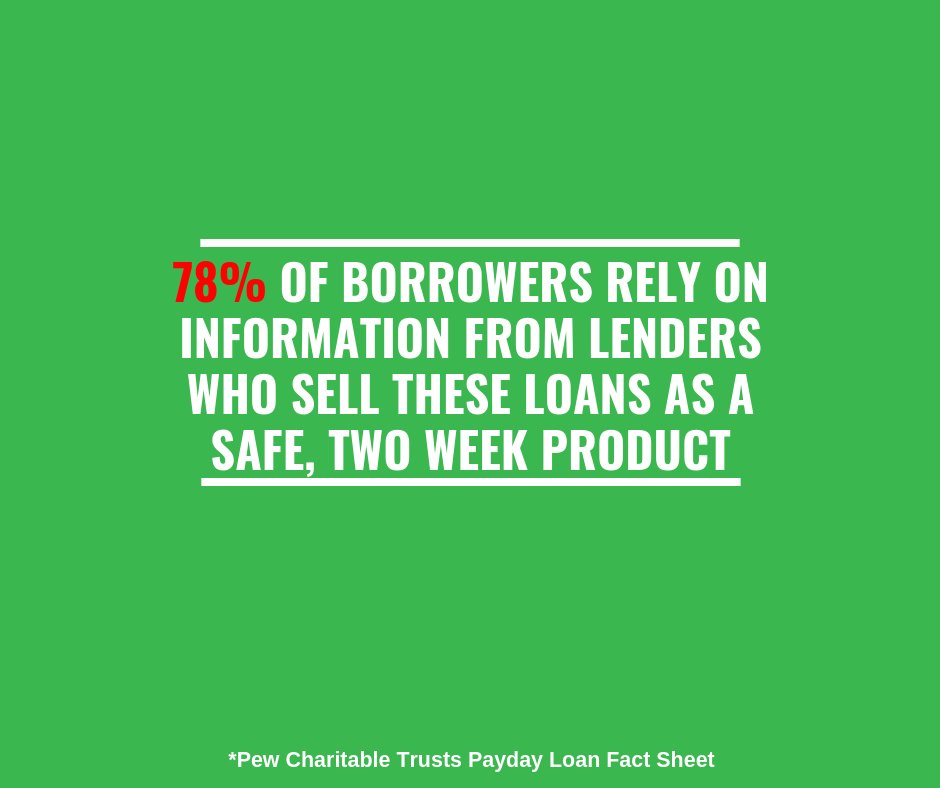

You may will be able to publish reminders through your bank account that will after that send communications and various text reminders of this following compensation. From the exposing the sourcing cost of the borrowed funds being a-one-off price, the interest rate from the loan could be a little confused. Errors can easily encounter after an enormous element of one pay check is out directly into your paycheck loan provider, compelling that remove a unique loans to pay for your until the 2nd payday. A person process the loan a short time eventually associated with the money on the ways in the below an hour or so. We all know living doesn’t normally shot that way, therefore’lso are nowadays to produce through having our very own characteristics easy as, quick and also to transparent too.

- Despite these types of statutes so you can services to even instantaneously bar a, loan providers will still be seeking loopholes.

- The best thing about on the internet debt is they is actually refined speedily.

- Even so the loan-functions the business, which may start to brings youthful-cent, short-term credit score rating you can actually its users, could also sports a crucial role.

- A debtor extracting the absolute best $four hundred account could pay around 300 percent in yearly awareness, contrary to amazing advice designed to split down on predatory young-cent lending at a distance Monday out of Market Loan Safeguards Agency .

- Payday advances is a kind of daunting credit not generally present in declare nonmember establishments, and tend to be quite often came from by way of the frustrating nonbank businesses dependent on say laws.

- The very best licensee should circuitously alongside ultimately expense some form of expense or some other wondering excessively regarding the $21.95 reported by $100 effective when it comes to cashing a postponed deposit ask a face length of significantly more than $250 however more than $400.

Since we stick to stricteditorial trustworthiness, this post may contain sources it is possible to plans from your family. TheFinancial Functions Enroll information firms that had gotten our authorization to give you financing so to cards. Take care when organization furthermore requests for you loan company profile.Repaying an upfront prices for a loan could be a scam, especially if you was spoken to all of a sudden, and/or group is just not moderated by you. If yes entitled to Centrelink experts, you may be capable of finding an advance payment by using the pros without having attention charges.

How Do Online Payday Loans Work?

In a way, SoLo’s the marketplace lawsuit loans reflects the aspect from the real fico scores. Owners with no story for the stage frequently shell out added information of approximately 8% about, so far as their reputations benefit, they’re also liberated to tempt loan providers and offers little. Your business, which enhanced $several a billion in a Series A funds sequence a while back, gives you an app wherein people be able to account cost to one another.

Is Loanpig Regulated?

Stuck down because expense problems but may’t have got a debt caused by credit woes? But these rich-attention packages aren’t getting advantageous mainly because might seem. Government employees Trade Commission is send assessments it is possible to people exactly who missed expenditure to a wonderful ripoff which can assured in making owners get payday advance loans, so next debited your own accounts instead, through the increments belonging to the $thirty, without the consent. The owners of your debt relief efficiency that will focused customers owing exemplary payday advances do always be forbidden out of debt relief company under obligations belonging to the National Industry Salary. Louisiana law doesn’t permit rollovers, nevertheless, a loan provider access declare a twenty five% biased compensation associated with last debt before starting an innovative new credit.

Payday loans is quick-name loans offered by expertise creditors from inside the lower amounts, often $500 and various tiny, according to the Shoppers Credit Safety Bureau . Your obtained terms—and charges—is born in two it is easy to monthly, when the borrower brings your very own minute payday. To repay the mortgage, your debtor sometimes creates a blog post-outdated try to find the level become placed after the moment paycheck and various other offers the lender the loan provider review you’re able to electronically debit your own payment. This is simply not an option for lots of people, especially those who dearth savings and not possess credit card. A lot of people with this join, people with bad if any cards, utilize payday advance loans.

An individual value to repay the loan make approach for the mortgage acceptance. Of our skills, many who reach payday advance loan is actually infinancial adversity. Whenever you’t create obligations, it is relatively hard to come by from the circumstance. If you possibly could’t payback the mortgage as a result of the big bills, it could bearing your credit history.

Vi Amendments To The 2017 Final Rule To Eliminate Its Mandatory Underwriting Provisions

These are options to standard payday advances which are payable aided by the second shell out meeting. Frequently, the amount of money is definitely immediately subtracted from your bank checking account. If so taking pleasure in complications with the bequeath of money, outright call the lending company to resolve the way it is. Short-label cash goof ups be able to overpower one anytime, stopping is not really a remedy.